Our Story

Wongafix kicked off its journey in August 2016 as a digital lending platform, driven by a mission to make financial solutions accessible and convenient for those who often get overlooked, like underserved individuals and micro-entrepreneurs.

Year founded

Loans Disbursed

On-time Disbursement

Our mission

Product Offerings

Spotting a significant gap in traditional banking services, Wongafix harnesses technology to offer quick, transparent, and inclusive credit options tailored for low-income earners and small businesses.

Payday Loans

Short-term loans designed for urgent personal needs. These loans provide quick cash to cover unexpected expenses or bridge the gap between paychecks, offering a safety net for individuals facing immediate financial demands.

Salary Advance Loans

Flexible credit options for salaried employees. This product allows employees to access a portion of their earned salary before their regular payday, providing them with the financial flexibility to handle unforeseen expenses or urgent needs without disrupting their long-term financial stability.

Emergency Loans

Quick access to funds for unexpected expenses. Life is unpredictable, and emergencies can arise at any time. These loans are designed to provide swift financial relief during such situations, helping individuals to address urgent needs like medical bills, car repairs, or other unforeseen costs.

Local Purchase Order

Working capital support for micro-businesses and SMEs. LPO Financing helps these businesses fulfill confirmed purchase orders by providing the necessary funds to procure and supply the goods or services. This enables them to manage their cash flow effectively, avoid delays in fulfilling orders.

Micro-Loans

Customized credit solutions for small-scale entrepreneurs. Micro-loans are specifically designed to meet the unique needs of small-scale entrepreneurs who often lack access to traditional financing options. These loans can be used for various purposes, such as purchasing inventory, upgrading equipment, or expanding business operations.

Our values

Our Mission & Vision

Mission

To empower individuals and small businesses by providing seamless access to financial resources, promoting economic growth and stability.

Vision

To emerge as the leading digital lender in Nigeria, closing the financial inclusion gap through innovative and customer-focused solutions.

Key Achievements

Loans Disbursed

On-time Disbursement

High repeat customer rate

Transparent pricing and flexible repayment options

Unique borrowers

SMEs funded

Meet the team

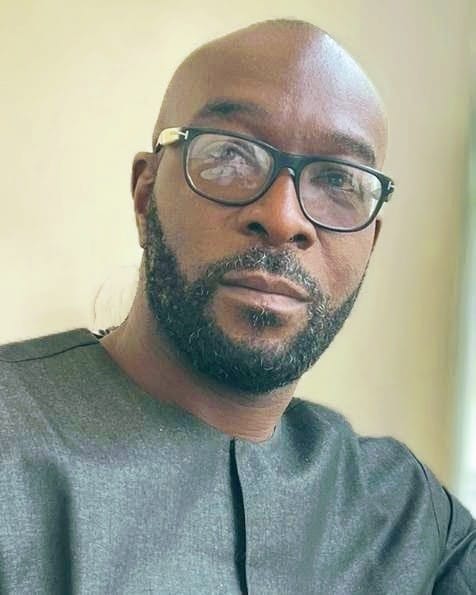

Adebola Thomas

Adebola Thomas is a Chartered Accountant and was previously with Shell Nigeria Exploration Production Company Ltd, SIAO Partners and Agusto & Co Ltd

Olabanke Nwaoze

A strategic thinker with a passion for innovation, Olabanke leverages her deep industry knowledge to drive financial inclusion and seamless lending experiences.

Her expertise in risk assessment and product development has been instrumental in shaping wongafix customer-centric lending solutions.

Committed to empowering businesses and individuals through accessible credit, she continues to lead with vision and excellence in the digital finance space.

Mercy Igbi

A results-driven financial leader with 20+ years of cross-functional expertise in insurance, marketing, facility management, and credit administration. At Wongafix, Mercy spearheads credit risk strategy, optimizing lending processes, ensuring compliance, and maintaining portfolio health.